The purchase returns and allowances account is offset against total purchases when calculating the cost of goods sold. Any difference between invoice price and reduced price (i.e., the price that is finally received from the customer) is known as allowance. This allowance should not be confused with the sales discount, which is initially entered in the cash receipts journal at the time of receiving cash from buyers.

Why You Can Trust Finance Strategists

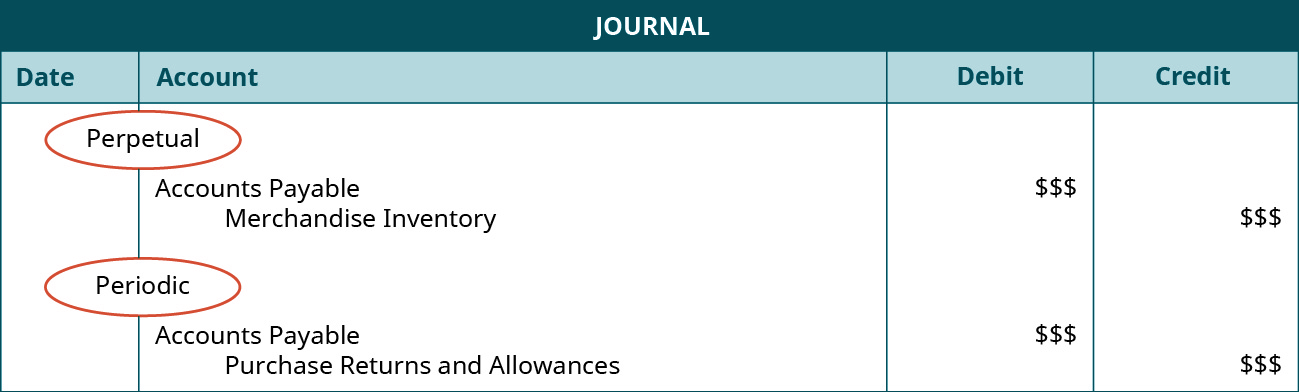

Companies using periodic inventory procedure make no entries to the Merchandise Inventory account nor do they maintain unit records during the accounting period. Under periodic inventory procedure, a merchandising company uses the Purchases account to record the cost of merchandise bought for resale during the current accounting period. The Purchases account, which is increased by debits, appears with the income statement accounts in the chart of accounts. As there are two methods of inventory accounting including periodic system and perpetual system, when the company returns the purchased goods, the journal entry in the two systems will be different. Hence, two companies that follow different inventory systems will have different journal entries for purchase return. Some companies may keep two separate accounts for purchase returns and purchase allowances.

Is there a different journal entry for merchandise returned for a credit note?

Advanced inventory management systems, such as Oracle NetSuite and SAP, offer integrated solutions that automate the return process. These systems can track returns in real-time, update inventory levels instantly, and generate detailed reports, providing businesses with a comprehensive view of their return activities. Automation reduces manual errors and speeds up the return process, allowing companies to focus on more strategic tasks. Incorrect orders occur when the received goods do not match the purchase order specifications. This can happen due to errors in order processing, picking, packing, or shipping. Handling incorrect orders involves verifying the discrepancy, communicating with the supplier, and arranging for the correct items to be delivered.

How to Record Purchase Returns and Allowances? (Explanation and Journal Entries)

Instead, it keeps the goods and receives an allowance or a price reduction. However, it affects the company’s purchases figure in its income statement. Usually, companies record purchase allowances in the same account as purchase allowances. To create a purchase return journal entry, you will first need to identify the merchandise that was returned. Next, you will need to record the credit that was given to you by the vendor or supplier. Finally, you will need to subtract the cost of the returned merchandise from your total sales for the period.

Managing Purchase Returns: Accounting, Impact, and Best Practices

FOB Destination means the seller is responsible for paying shipping and the buyer would not need to pay or record anything for shipping. FOB Shipping Point means the buyer is responsible for shipping and must pay can an unemployed person file a federal tax return and record for shipping. To update your inventory, debit your Inventory account to reflect the increase in assets. And, credit your Cost of Goods Sold account to reflect the decrease in your cost of goods sold.

Integrating purchase returns into inventory management also involves assessing the condition of returned goods. Items that are in resalable condition can be reintegrated into the inventory, while defective or damaged goods may need to be repaired, repurposed, or disposed of. This assessment process requires coordination between the inventory management team and quality control departments to determine the best course of action for each returned item. By efficiently handling returns, businesses can minimize waste and optimize the use of their resources. Effective documentation is another critical aspect of accounting for purchase returns.

- This allowance should not be confused with the sales discount, which is initially entered in the cash receipts journal at the time of receiving cash from buyers.

- However, they do not directly impact the purchases account in the general ledger.

- Therefore, the supplier has to receive those goods back and make the subsequent entry in their accounts and ledgers to ensure that they can maximize the overall returns.

The first approach is to record returns and allowances in the general journal, which is appropriate for companies with only a few returns and allowances during the year. The second one is to record these transactions in a special journal known as the sales returns and allowances journal. The second approach is more convenient for companies that experience too many such transactions during the year.

Each return should be accompanied by a return authorization form, detailing the reason for the return, the condition of the returned goods, and any actions taken, such as refunds or replacements. This documentation not only supports the accounting entries but also provides a clear audit trail, which is essential for internal controls and external audits. Moreover, maintaining detailed records of purchase returns can aid in analyzing return patterns, helping businesses identify recurring issues and implement corrective measures.