In most cases, companies receive payments through the bank for this process. However, companies may also issue shares in other cases, for example, in exchange for goods or services. When it issues no-par stock with a stated value, a company carries the shares in the capital stock account at the stated value. Any amounts received in excess of the stated value per share represent a part of the paid-in capital of the corporation and the company credits them to Paid-In Capital in Excess of Stated Value. The legal capital of a corporation issuing no-par shares with a stated value is usually equal to the total stated value of the shares issued. Since the company may issue shares at different times and at differing amounts, its credits to the capital stock account are not uniform amounts per share.

Capitalization of Shareholder Loans to Equity

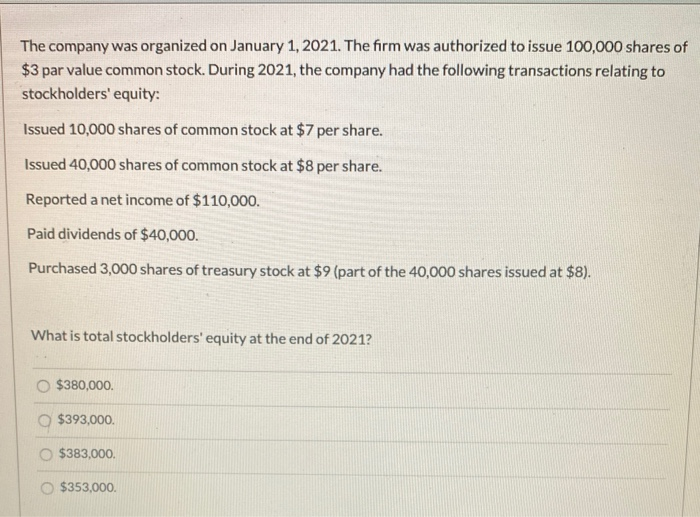

Stock issuance is when a company sells new shares to investors. This can involve common stock or preferred stock, which may be issued at par value, above par, or below market value. 4As mentioned in a previous class, the sales of capital stock that occur on the New York Stock Exchange or other stock markets are between investors and have no direct effect on the company. Issued Shares are the number of shares that company sells to investors. They are the authorized shares that sold to the investors in the market. They will receive cash as the number of shares are sold to the investor.

Financial Accounting

Though, the par value of the common stock is registered as $1 per share on the stock certificate. In practice, the issuance of stock at a discount (i.e., below its par value) is not usual because it is legally prohibited in many countries and states. This legal restriction partially explains why companies mostly choose a very low par value for their stock.

Common Stock Issued for Non-Cash Exchange

To offset this addition to assets, you’ll then increase shareholders’ equity by the same amount. If you issue shares with a par value, then you’ll often split the increase into two categories. The equity attributed to the common stock’s par value will increase by the number of shares issued multiplied by the par value per share. Any remaining proceeds will increase the line item for additional paid-in capital in excess of par value. The differentiation between the two accounts depends on the share’s par value. Accounting standards require companies to recognize the finance received from issuing shares in the two accounts.

6: Journal Entries to Issue Stock

The most common example of common stock being sold by a company is for the exchange of cash. A company will take those funds and invest them into the business by applying the cash to new investments. In the most simple form, you will see a deposit into the firm’s bank account and then issuance of common stock, i.e. an increase in the company’s capital. In particular, dealing what does “gaap” stand for and what is its primary purpose with shares, or common stock, can be daunting for the accounting student and small business owner alike. You have par values, share premiums, applications, allotments, calls and all sorts of things that can go on. So there is a complication to deal with, but with our comprehensive guide, preparing a journal entry for issue of common stock is very straightforward.

Accounting for Common Stock

Stock can be issued in exchange for cash, property, or servicesprovided to the corporation. For example, an investor could give adelivery truck in exchange for a company’s stock. Another investorcould provide legal fees in exchange for stock. The general rule isto recognize the assets received in exchange for stock at theasset’s fair market value. For instance, some businesses will issue stock in exchange for tangible assets or real property.

- In most circumstances, common stock is the only type of equity instrument that companies may issue.

- Instead, they promise this distribution if the company chooses to do so.

- Before we dive into the recording process, let’s briefly understand what common stock is.

- In this case, the debit side of the journal entry will be the expense amounting to the cost or the fair value of the service that needs to be charged to the income statement instead.

Different from issuance for cash, the issue of stock for non-cash requires the company to define the market value of both stock and noncash assets. The issuance price will depend on one of the market values if it is more reliable. In most cases, the stock market value is more reliable as they trade in the capital market with many buyers and sellers. Unless the stock market value is not available, then asset fair value will be use.

But if the stock market value is not available, we can use the asset’s fair value. If assets fair value also not available, management can determine the assets or service value. It is the lowest amount that the company can sell the stock for.

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Making the right entries on your books is crucial if your business offers equity to investors. And as we know before, 5 per cent of this is the par value, and the remaining 95 per cent is the additional paid-in capital or premium the shareholders are paying above par value. The first debit entry takes the $400,000 in application money out of the application account. If then splits this across the Class A Share Capital account, being the allotted money. Then theClass A Additional Paid-in Capital account, as we calculated above.

Par value may be any amount—1 cent, 10 cents, 16 cents, $ 1, $5, or $100. The cost method of accounting for common stock buy-backs is the simplest approach and caters well for the three scenarios you might face. We’ll look at each scenario providing the journal entries and calculations required.

Stock may be issued for assets other than cash, such as services rendered, land, equipment, vehicles, accounts receivable, and inventory. This is more common in small corporations than in larger ones. The journal entries are similar to those for issuing stock for cash. In this case, the value of either the stock or the asset must be known. The assumption is that both the asset and the stock have the same value. As mentioned, the share capital account will only include the par value of the shares.